Harnessing Home Equity: Unlocking Your Canadian Dream of a Vacation Property in El Salvador

Harnessing Home Equity: Unlocking Your Canadian Dream of a Vacation Property in El Salvador

Dreaming of a sunny escape during the long, harsh Canadian winters? Yearning for a vacation property where you can relax, rejuvenate, and create lasting memories? If you're a homeowner in Canada, you might have a hidden asset that can help turn these dreams into reality. By tapping into your home equity, you can explore the possibility of purchasing a vacation property in El Salvador. In this blog, we'll delve into how you can leverage your home equity for a delightful getaway, all while planning for retirement and embracing a life of enjoyment.

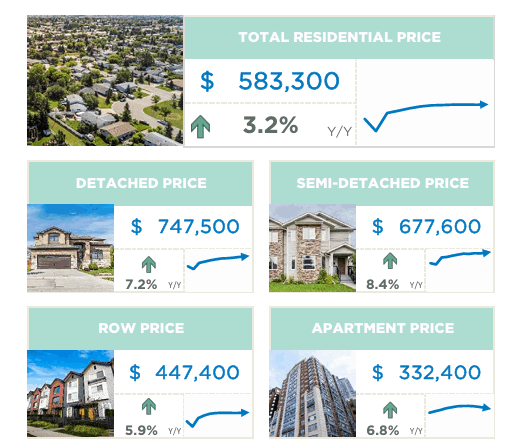

1. Understanding Home Equity:

Home equity is the difference between the market value of your home and the outstanding balance on your mortgage. As you make mortgage payments over time and your property appreciates in value, your home equity increases. It's a valuable resource that can be utilized to finance various endeavours, such as buying a vacation property.

2. Assessing Your Financial Situation:

Before embarking on this exciting venture, it's crucial to assess your financial situation. Consider factors such as your current mortgage balance, your credit score, and your overall debt-to-income ratio. Additionally, evaluate your ability to comfortably manage two properties, accounting for potential expenses like maintenance, property management fees, and insurance costs.

3. Researching the Vacation Property Market in El Salvador:

El Salvador, a tropical paradise nestled in Central America, offers breathtaking landscapes, pristine beaches, and a vibrant culture. We will conduct thorough research on the real estate market in your desired location. Guide you through the process, provide insight into property values, and help you find a suitable vacation home within your budget.

4. Utilizing Home Equity Options:

Now that you're armed with knowledge about the vacation property market, it's time to explore your options for leveraging home equity. Here are two common methods:

a. Home Equity Loan: A home equity loan allows you to borrow against the equity in your Canadian property. The loan amount is determined based on the appraised value of your home, minus any outstanding mortgage balances. With the funds received, you can purchase a vacation property in El Salvador.

b. Home Equity Line of Credit (HELOC): A HELOC is a flexible line of credit that lets you borrow against your home equity as needed. It provides access to funds up to a certain limit, which you can withdraw and repay according to your requirements. This option offers greater flexibility and can be particularly useful if you're uncertain about the exact amount needed for your vacation property.

5. Planning for Retirement:

Investing in a vacation property can also be a wise strategy for planning your retirement. By securing your dream getaway in El Salvador, you're setting the stage for a future where you can spend winters in a warm climate and enjoy a relaxed lifestyle. Additionally, if you choose to rent out your vacation property during the months you're not using it, it can generate additional income that can support your retirement plans.

6. Embracing Life's Enjoyment:

Purchasing a vacation property in El Salvador isn't solely about financial benefits or retirement planning—it's about embracing a life of enjoyment. Imagine waking up to the soothing sound of ocean waves, exploring vibrant local communities, and immersing yourself in the rich cultural experiences this tropical destination has to offer. Your vacation property will serve as a haven where you can create lasting memories, reconnect with loved ones, and truly savour life's moments.

Leveraging the equity on your Canadian house to purchase a vacation property in El Salvador opens doors to a world of possibilities. With careful financial planning and research, you can turn your dreams of a winter escape and retirement haven into a reality. So why wait? Start Now!

Categories

Recent Posts